Affordability – A special cartoon gallery (December 28, 2024)

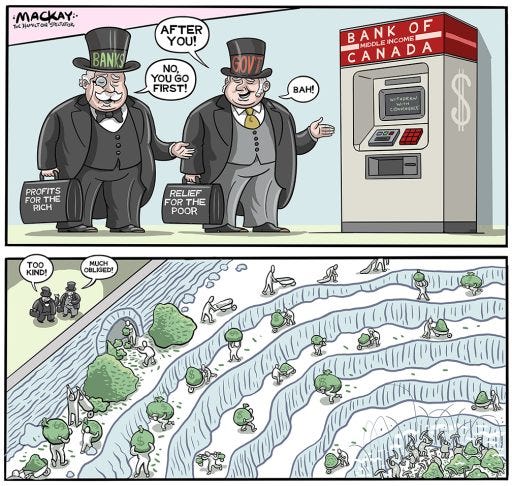

These editorial cartoons over the past few years highlight the tough times many Canadians have and are currently facing with rising living costs, especially when it comes to food. They point out how prices for everyday items, like groceries and butter, have skyrocketed, making it harder for families to make ends meet. The increase in food bank use shows the growing need for support as government action seems slow.

While some retailers are trying to improve practices, there’s a sense that more needs to be done to tackle the bigger problems affecting people’s wallets. Short-term solutions, like HST holidays and rebates, might provide temporary relief, but they don’t address the root issues. What’s truly needed are long-term remedies that ensure sustainable affordability and economic stability for all Canadians. Overall, it’s a call for better solutions to help everyone cope with these financial challenges in a meaningful way.

Friday December 10, 2021: We’ll all be paying a lot more for food next year, says Canada’s Food Price Report. Sky-high food prices were one of many negative impacts that Canadians felt during the pandemic-plagued year of 2021. And a new report suggests that problem is only going to get worse next year.

Thursday September 29, 2022: Butter is our lifeblood, our saving grace. When all else fails, butter is there for us to spread on toast, toss into mashed potatoes, shower on our movie popcorn, or use to whip up a cake. But this essential ingredient is starting to cost a pretty penny, and right before its biggest time to shine, the holiday baking season.

Thursday April 13, 2023: Move over, Tiffany’s! The hottest place to shop for precious commodities is now your local supermarket. With prices soaring to new heights, Canadians are flocking to grocery chains with the same excitement and anticipation as shopping for gold, diamonds, and expensive gems in a jewelry store.

Wednesday August 2, 2023: Inflation has been a significant concern for the Canadian economy, impacting all aspects of daily life, with grocery prices being hit the hardest. In recent months, the cost of living has surged by almost six percent, while grocery prices have soared nearly double that pace, leaving consumers feeling the pinch. As prices rise, the profits of big grocery chains have reached record highs, further exacerbating the disparity between their financial success and the plight of their low-wage workers.

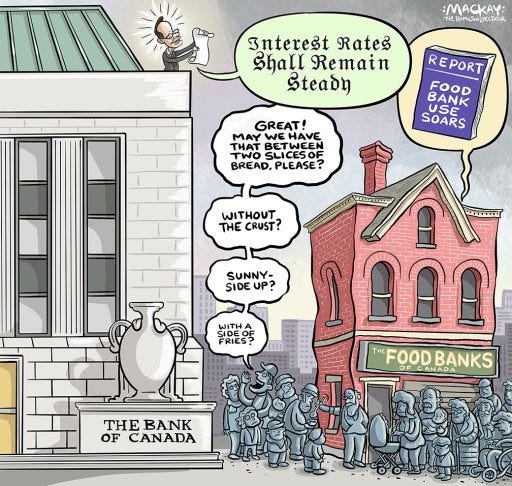

Thursday October 26, 2023: Yesterday’s announcements highlight the challenges of high inflation and housing costs in Canada. The report on food banks shows the growing need for affordable options, while the Bank of Canada’s focus on managing inflation could lead to rate hikes. It’s clear that addressing affordability, inflation, and social support is crucial.

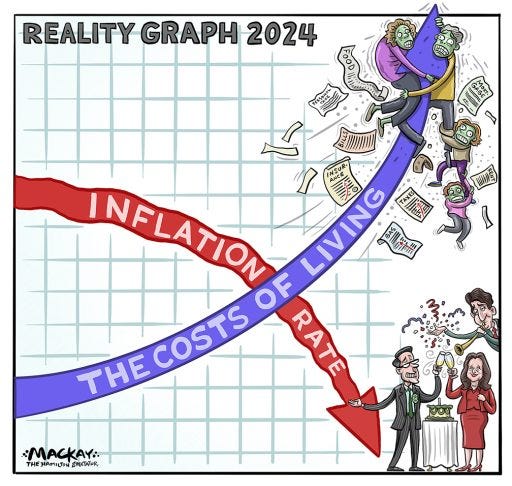

Tuesday March 5, 2024: Despite falling inflation, the Bank of Canada is likely to keep interest rates steady, raising questions about an immediate drop in borrowing costs.

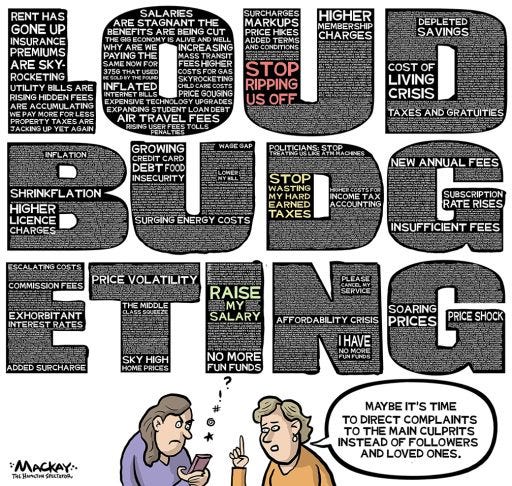

Tuesday March 11, 2024: Loud budgeting emerges as a powerful societal roar against corporate exploitation, stagnant wages, and governmental financial burdens, empowering individuals to reclaim control over their finances and challenge systemic inequities.

Tuesday April 9, 2024: Today’s youth face a profound struggle with financial insecurity and societal pressures, hindering their ability to engage amid a pervasive cost of living crisis.

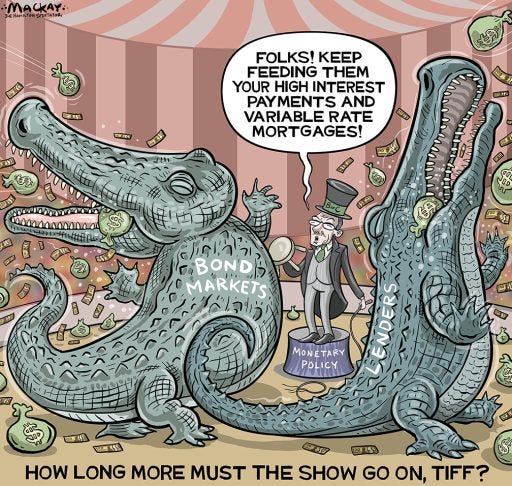

Thursday April 11, 2024: The decision by the Bank of Canada to maintain interest rates at 5% underscores the economic struggles faced by middle-income families, who play a vital role in driving economic activity but bear the brunt of stagnant wages, rising costs of living, and financial pressures exacerbated by high borrowing costs.

Saturday May 18, 2024: The recent announcement that Loblaw Companies Ltd. and other major retailers are ready to sign on to Canada’s grocery code of conduct is being presented as a significant step toward fairer practices within the grocery supply chain. However, this development is unlikely to bring about the substantial changes needed to address the deeper issues affecting the industry and consumers.

Friday May 31, 2024: Innovative leadership is essential to address Canada’s inflation crisis, bridging the gap between optimistic official statistics and the harsh financial realities many Canadians face.

Thursday June 6, 2024: Amidst the Bank of Canada’s rate cuts offering borrowers a glimmer of hope, the rollercoaster journey of economic recovery is shadowed by the relentless challenge of rising living costs.

Friday September 13, 2024: The rise in food bank usage highlights government inaction on poverty, housing, and social services, and food banks cannot continue to serve as a substitute for systemic reform

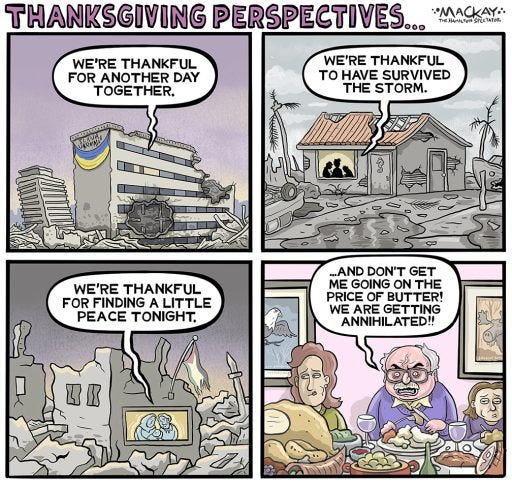

Saturday October 12, 2024: Despite rising grocery prices, Thanksgiving 2024 offers an opportunity to reflect on the privileges many Canadians still enjoy, like access to affordable food and relative safety, even as global challenges intensify.

Hello, friends!

As 2024 winds down, I’m excited to share my editorial cartoons through The Graeme Gallery, my Substack newsletter inspired by a cherished Hamilton Spectator tradition. For 28 years, I’ve used cartoons to recap the year’s big stories—locally and globally—with humour and insight.

These annual retrospectives are the inspiration for what I now offer weekly on Substack: newsletters delivered every Saturday, summarizing the week’s events through my cartoons. Subscriptions are free while I remain a staff cartoonist with legacy media.

This year-end series kicks off December 26 with four special posts:

* Dec. 26: Ontario’s key moments.

* Dec. 27: Canada’s ups and downs.

* Dec. 28: The cost-of-living crisis.

* Dec. 29: Donald Trump’s 2024 antics.

Thank you to the 100+ subscribers who’ve already joined—your support keeps this art form alive. Please spread the word, and let’s celebrate satire together.

Happy holidays and here’s to a bright 2025! —Graeme